KPMG says sustainability viewed as a board responsibility

In Anchoring ESG in governance, a new report from KPMG, global sustainability leaders reveal how they are using governance structures, strategies, systems and controls to successfully embed ESG.

The interviews re-emphasise the growing acceptance that organisations need to transform if they want to continue to succeed or indeed, even exist in 10-20 years from now.

The interview responses, from over 50 chief sustainability officers and other ESG-responsible managers, were consistent with the views expressed by New Zealand board members in What Difference Can Directors Make?, a recent report developed in collaboration with KPMG New Zealand and Chapter Zero New Zealand.

They explore in detail how sustainability focused organisations, and group sustainability units in particular, operate. Key findings confirm that sustainability has arrived at the top of corporate structures and is viewed as being a board-level responsibility, led by Chief Executive Officers in almost half of the corporates in the research. Almost all have made it a strategic issue or adopted a purpose-driven approach.

However, ESG-linked remuneration and ESG KPIs are still rare, though trends indicate that many firms are planning to address this gap imminently.

For now, hot topics remain: decarbonising business models and reducing greenhouse gas emissions, followed by diversity, equality and inclusion and human rights in the value chain. These topics will all resonate for New Zealand organisations under increasing pressure to disclose their carbon footprint, set emissions reduction targets, and develop strategies to mitigate climate risks.

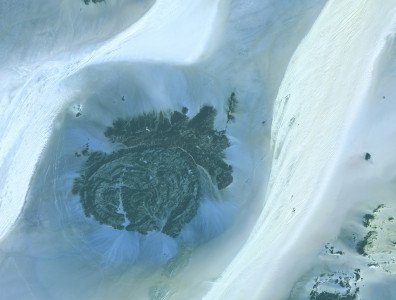

Although not highly represented in the survey, a number of respondents also highlighted the increasing relevance of nature and biodiversity as a key ESG topic - again a trend we are seeing in New Zealand board discussions, against the backdrop of the global launch of the Taskforce on Nature-related Financial Disclosures (TNFD).

To move at the pace of global businesses and to ensure resilience and competitiveness, long-term viability, and shareholder value, New Zealand based directors should not underestimate the significance of placing ESG governance at the top of their organisations’ priorities. If the transformation is not started now, then when?