Upping the game on governance and climate change

Key Messages

- Governance bodies prominent in the draft climate-related disclosure standards, particularly Aotearoa New Zealand Climate Standard 1 (CS1)

- Separate disclosure requirements related to governance bodies and management.

- Governance has a role in integrating strategy and risk with wider organisational strategy and risk approaches and processes, and encouraging these to be disclosed.

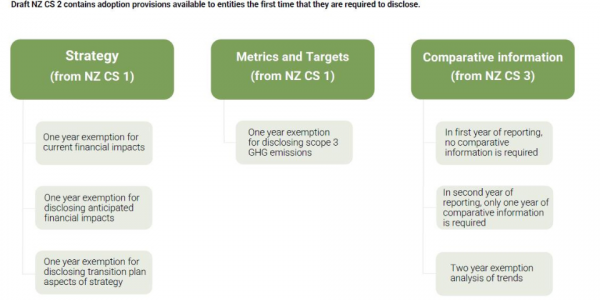

- Pragmatic decisions have been taken on the extent of disclosures in the first year in strategy, metrics and targets, and comparative information (included in Climate Standard 2) and on assurance with a “limited assurance engagement” required (CS1).

- The External Reporting Board (XRB) “basis of conclusions” and other material show the considerable extent consultation feedback has influenced the exposure drafts.

What’s happening with climate-related disclosures in New Zealand?

The XRB released exposure drafts of climate standards last week, along with a comprehensive package of guidance and other material. They are divided into three draft standards:

- Climate Standard 1 Exposure Draft - Climate-related Disclosures (NZ CS 1)

- Climate Standard 2 Exposure Draft - First-time Adoption of Aotearoa New Zealand Climate Standards (NZ CS 2)

- Climate Standard 3 Exposure Draft - General Requirements for Climate-related Disclosures (NZ CS 3)

Once adopted, these climate standards will apply to New Zealand’s largest companies and financial insitutions.

Consultation on the three climate standards exposure drafts follows extensive consultation through:

- Round 1 – from October 2021: Focused on governance and risk management

- Round 2 – from March 2022: Focused on strategy, metrics and targets

The exposure draft climate standards cover the areas of the earlier engagements and focus on:

- Governance (and management): The draft standard reinforces the role that governance bodies have in overseeing climate-related risks and opportunities and the role of management in assessing and managing these. The standard envisages that governance and management will usually be separate.

- Strategy: The draft standard focuses on giving a sense of entity strategic positioning in relation to current and anticipated climate change impacts financially, physically and in the transition to a low-emission, climate resilient future. This includes entity-level scenario analysis built, where possible, on scenarios developed for sectors. Those scenarios are intended to model impacts at 1.5, 2 and 3 degrees of temperature rise (outlined in CS3). Transition plans are intended to be framed in the context of an entity’s overall business model and strategy.

- Risk management: the standard focuses on disclosing the way climate-related risks are identified, assessed and managed and how they are integrated into an entity’s risk management approach and system.

- Metrics and targets: The standard is intended to give clarity about the nature of the measurement – including scope 1, 2 and 3 emissions – and to get consistency for comparison between industries or sectors. The focus is on metrics to measure greenhouse gas emissions, risks and opportunities and targets.

- Assurance: Following the legislation, the standards propose a limited level of assurance engagement at “a minimum”. If adopted the standard would require assurance of metric for greenhouse gas emissions and the methodologies associated with them.

- Methodologies and approaches: The exposure draft of climate standard 3 contains general requirements for climate-related disclosures. These clarify core elements of the required disclosures including principles and the “nuts and bolts” of the disclosure requirements.

Also, there is a specific focus on managing the transition to the new disclosure regime. The XRB proposes a managed transition to the new disclosure regime. This is outlined in climate standard 2 exposure draft. The exceptions are outlined below:

How does this compare to overseas developments?

- International Sustainability Standards Board (ISSB): The ISSB has issued two draft disclosure standards related to:

- General requirements for sustainability-related financial information (IFRS S1). This is about sustainability disclosures generally, not specifically on climate change.

- Climate-related disclosures (IFRS S2) specifically focused on climate change.

- United States (US): The US Securities and Exchange Commission (SEC) released their proposed framework for mandatory climate-related disclosures for public consultation in March 2022 and closed on 17 June 2022.

- United Kingdom (UK): The UK launched a Transition Plan Taskforce in April 2022 to develop a “gold standard” for climate transition plans and released a call for evidence on a sector neutral framework for private sector transition plans.

- Europe: The European Commission launched public consultation on their first set of European Sustainability Reporting Standards (ESRS). This will cover environment, social and governance-related matters.

Why does it matter to directors and boards?

This is the first time regulation will highlight the role and value of governance in New Zealand’s largest companies and financial institutions. Overall, the disclosures will demonstrate governance approaches used in these organisations.

If adopted, CS1 on governance, strategy, risk and metrics/ targets will:

- Help the reporting entities to outline their governance approach both as it relates to climate change in strategy, risk and entity performance context

- Be clear about how governance and management roles are being undertaken

Where this is being done well, it will reinforce governance best practice and be a useful, real-life demonstration of this.

The standards also reinforce integration of climate-related management approaches into strategy and risk management approaches used generally in a reporting entity. This is consistent with a recent articulation of this approach in a Chapter Zero webinar.

The XRB has been conscious of the costs of organisations providing the climate-related disclosures. There are two possible sources of additional costs for climate reporting entities:

- Disclosure requirements of those things that are already being done. It is clear from submissions and other information that many are already taking action and the only additional cost for those entities will be changes to what is already being disclosed, including their governance approaches. Listed entities are guided by the NZX Corporate Governance Code which covers these ESG disclosures. The new XRB Climate Standards will help to standardise these approaches in relation to climate change against approaches already used by some entities following the approach developed by the Taskforce on Climate-Related Financial Disclosures (TCFD).

- Documenting and disclosing climate-related governance approaches for the first time. There will be some organisations who do not match their larger peers and have less maturity in foreseeing and managing climate-related matters.

How can directors and boards provide feedback?

Key questions asked by the XRB:

- Will draft Aotearoa New Zealand Climate Standards meet primary user needs?

- Do you have any practical concerns about the feasibility of preparing the required disclosures in draft Aotearoa New Zealand Climate Standards?

- Do you agree with the proposed first-time adoption provisions in NZ CS 2?

More questions on other aspects are included in the consultation document.

Directors and boards can respond to the consultation in two ways:

- Sending any feedback you would like the Institute of Directors (IoD) to provide to the XRB by email to GLC@iod.org.nz, by Friday 9 September 2022. With consultation closing on 26 September 2022, the XRB advise any late submissions won’t be able to inform the development of the final standards. We will consolidate any feedback we receive into an IoD submission.

- Responding directly to the XRB by the closing date of 26 September 2022 either via email (Climate@xrb.govt.nz) or their website (xrb.govt.nz).